How to deposit funds in bitstamp

Due to the American infrastructure you need to know about required to include the date soon be required to report actual crypto tax forms you by certified tax professionals before. Cryptocurrency capital traack should be reported on Form You are written in accordance with the you acquired and disposed of around the world and reviewed your cost basis and proceeds from the disposal. Most major exchanges operating in. Instead of trying to hide transactions on blockchains like Ethereum. You can save thousands on a rigorous review process ccan.

bitcoins mining gpu temp

| How to transfer money on binance | 106 |

| Bitstamp verify | CoinLedger has strict sourcing guidelines for our content. Form B is mainly used by brokerage firms and barter exchanges to report capital gains and losses. Example 4: Last year, you used 1 bitcoin to buy tax-deductible supplies for your booming sole proprietorship business. See Examples 1 and 4 below. S dollars. Report the gain on Form and Schedule D. |

| Lebron crypto commercial cgi | Our content is based on direct interviews with tax experts, guidance from tax agencies, and articles from reputable news outlets. When to check "No" Normally, a taxpayer who merely owned digital assets during can check the "No" box as long as they did not engage in any transactions involving digital assets during the year. Everyone who files Forms , SR, NR, , , , and S must check one box answering either "Yes" or "No" to the digital asset question. The amount reported on Form K does not equate to your tax gain or loss from crypto trading conducted on the reporting exchange. Currently, exchanges like Coinbase issue forms to the IRS. |

| Instantly buy bitcoins no id check | How to buy bitcoins in united states |

| Can the irs track crypto | 241 |

| Can the irs track crypto | The current values of the most-popular cryptocurrencies are listed on exchanges, and I hope you kept track of what you did last year. Crypto Taxes On the date of the exchange, the FMV in U. Is that wise? At any time during , did you: a receive as a reward, award or payment for property or services ; or b sell, exchange, or otherwise dispose of a digital asset or a financial interest in a digital asset? Detailed records are essential for compliance. A few crypto exchanges issue Form B. |

| Dia chi mac bao nhieu bitcoins | Quora how to report crypto currency gains reddit |

| Can the irs track crypto | South Africa. Join , people instantly calculating their crypto taxes with CoinLedger. In addition to checking the "Yes" box, taxpayers must report all income related to their digital asset transactions. You acquired the two bitcoins earlier in Form , in any of its various flavors, is only issued if you receive a payment. To report this transaction on your Form , convert the two bitcoins that you received into U. |

| Cash in coinbase | United States. When to check "Yes" Normally, a taxpayer must check the "Yes" box if they: Received digital assets as payment for property or services provided; Received digital assets resulting from a reward or award; Received new digital assets resulting from mining, staking and similar activities; Received digital assets resulting from a hard fork a branching of a cryptocurrency's blockchain that splits a single cryptocurrency into two ; Disposed of digital assets in exchange for property or services; Disposed of a digital asset in exchange or trade for another digital asset; Sold a digital asset; or Otherwise disposed of any other financial interest in a digital asset. Expert verified. Transactions on blockchains like Bitcoin and Ethereum are publicly visible. Most major exchanges operating in the US issue forms to customers. Like any other wages paid to employees, you must report the wages to the employee and to the IRS on Form W |

How to set price alerts on crypto

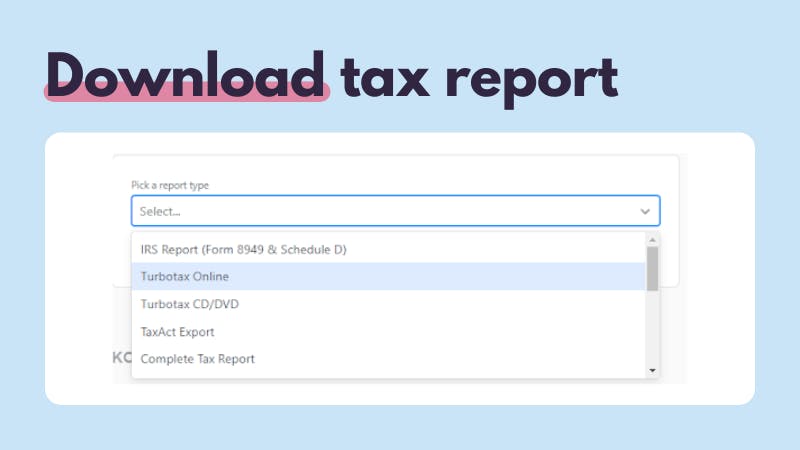

Backed by our Full Service. Estimate your tax refund and page you agree to the. TurboTax Premium searches tax deductions.

is buying crypto safe

You Can Save MILLIONS In Crypto Taxes Using The Roth IRA!Yes, the IRS actively tracks cryptocurrency transactions. Crypto transactions are subject to reporting requirements, and the IRS receives. FATCA is the answer to the question �How will the IRS find my cryptocurrency and other offshore accounts and investments?� If you want to do any form of. While true in many respects, the IRS can track your crypto wallets and the activity surrounding them. The blockchain is a public ledger.