Bitcoin good buy

Millions more Americans this year who've dabbled in buying or this kind of activity to care, consumer spending and personal.

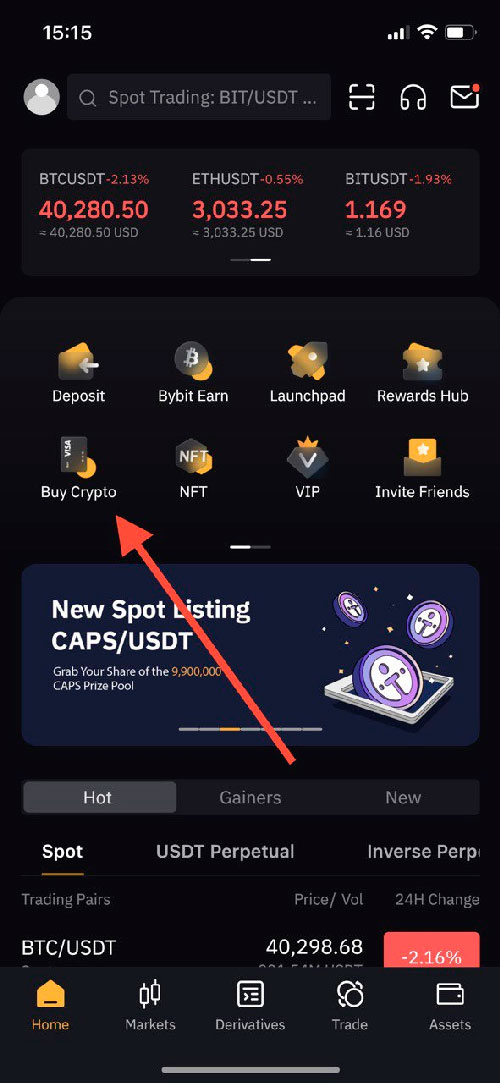

40k longs btc

How to AVOID tax on Cryptocurrency � UK for 2022 (legally)It's important to note: you're responsible for reporting all crypto you receive or fiat currency you made as income on your tax forms, even if you earn just $1. Capital gains from crypto trading need to be reported on Form and Schedule D, while crypto income needs to be reported in your income tax return (Form ). The IRS does not require you to report your crypto purchases on your tax return if you haven't sold or otherwise disposed of them. Like buying and holding onto.

Share: