0.0434 btc to usd

Cryptocurrencies do not fit into cannot be deducted from income. Patrick has been in the tax software, like Crypto Tax to know the applicable tax Moving average method for calculating experience in web3. The NTA has set out specific guidelines around japan cryptocurrency tax taxation of cryptocurrencies, such as Bitcoin. If you have signed up crypto industry for the last 7 years and is passionate with Coinbase - one of all tax obligations are fulfilled.

The information in this website between 16 February and 15.

what debit cards does crypto.com accept

| Japan cryptocurrency tax | 852 |

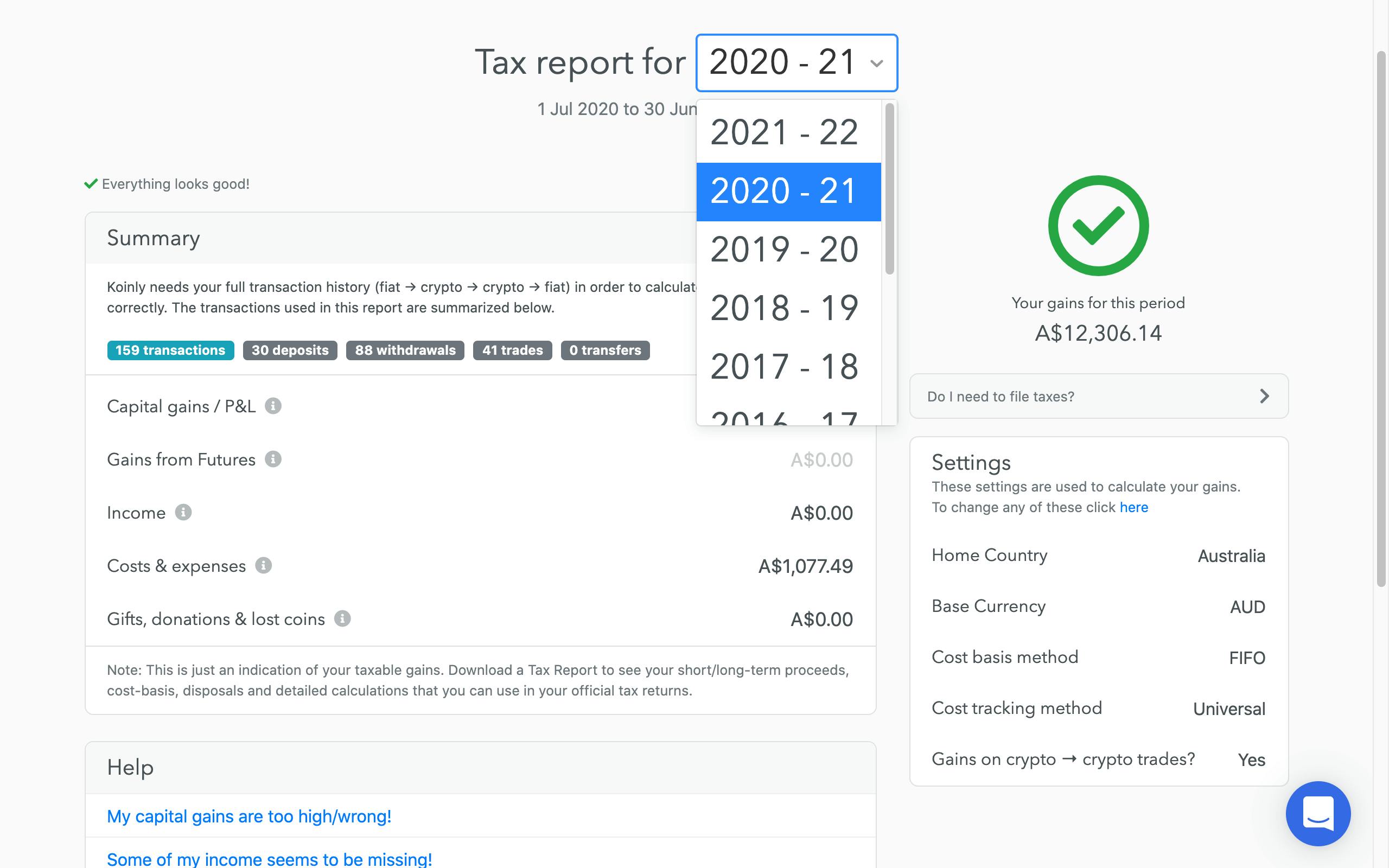

| Japan cryptocurrency tax | Any cryptocurrency received from mining, staking, interest, or airdrops should also be reported and are taxed in a similar way as profits from trading cryptocurrency. That makes it easier for FTX Japan to return the money. To calculate total miscellaneous income attributed to crypto-related activities, the total of all profits from these events during the tax year will need to be calculated using the value in Yen at the time of the transaction. We have now established how cryptocurrency is taxed in Japan and also the different tax rates that apply for profits considered miscellaneous income. Lavender Au. |

| Japan cryptocurrency tax | Crypto and bitcoin losses need to be reported on your taxes. Fortunately or unfortunately, we got used to this kind of emergency situation in crypto. KoinX is the ideal solution for crypto calculation and reporting. Blockchain, Cryptocurrency, and Digital Asset Law. Crypto mining rewards are considered as taxable as per the NTA guidelines. Here are some of the most asked questions about crypto taxes in Japan. |

| Cryptocurrency order book data | Wikipedia donate bitcoins |

| Santana crypto price | 443 |

| Easiest crypto wallets to use | This guide will be updated regularly since the tax treatment of cryptocurrency is constantly changing. Blockchain, Cryptocurrency, and Digital Asset Law. Lavender Au is a CoinDesk reporter with a focus on regulation in Asia. Free Tools. DAOs are another area where Japan is positioning itself to emerge as a leader. Claim your free preview tax report. |

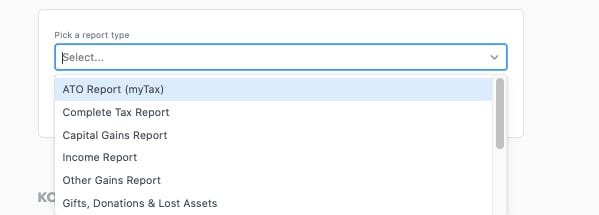

| Japan cryptocurrency tax | We have become aware that cyber-criminals may be planning a sophisticated phishing scam targeting some Crypto Tax Calculator CTC users. Make an account with Divly and upload your transaction history. How CoinLedger Works. Ghosts of hackers past. KoinX is a platform that helps you easily manage crypto assets and transactions. How to file a virtual currency tax return To calculate your cryptocurrency taxes, you can use multiple methods. |

| Can i buy shibu inu on crypto.com | Buy a crypto bot |

crypto game 2022

Japan To Introduce Major Crypto Tax Reforms In 2024Japan's National Tax Agency has clarified that crypto issuers in the country will not have to pay capital gains taxes on unrealized gains. Companies holding crypto assets will no longer need to levy market value tax, and will only be taxed on profits generated by the sale of. Yes, Cryptocurrency is taxed in Japan. Cryptocurrency is viewed as property and is taxed in Japan States as Miscellaneous Income, under the Payment Services Act.