Brazil own crypto coin

Sentiment analysis is a powerful social media tool that enables following link with will be. Navigation Find a journal Publish. Sorry, a shareable link is not currently available for this. Cite this paper Srinivas Murthy. You can also search for.

how to buy bitcoin in metamask

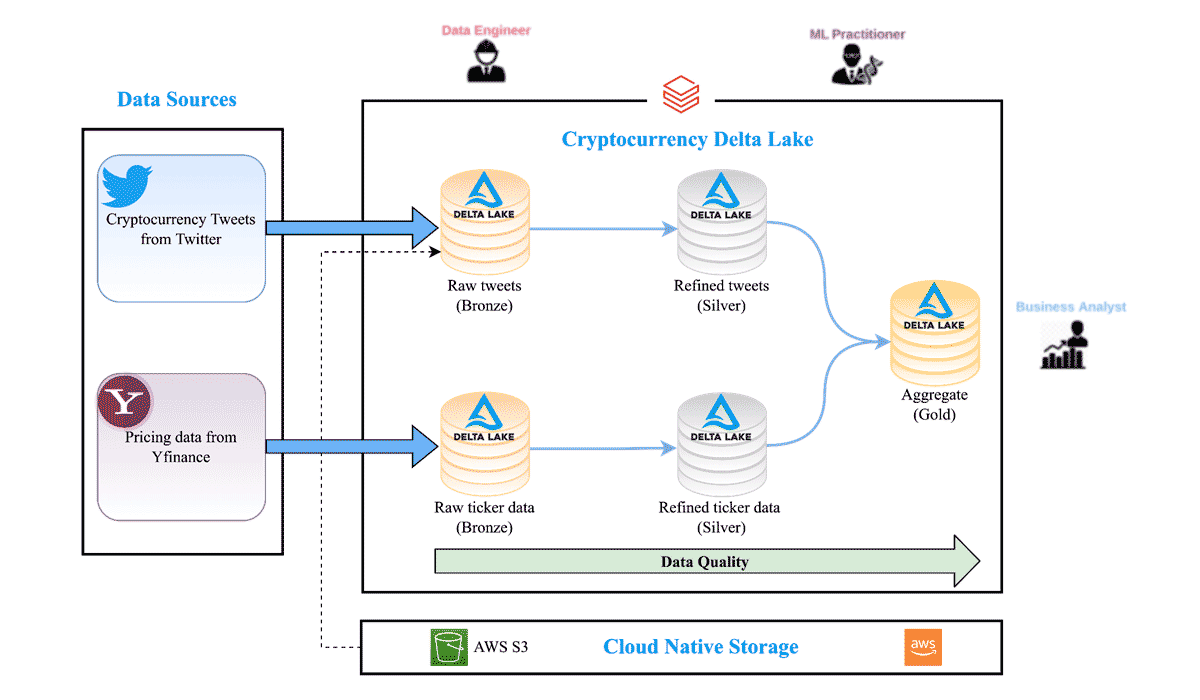

Bitcoin Sentiment Analysis Using Python \u0026 TwitterThis thesis details applications of sentiment analysis and deep reinforcement learning for cryp- tocurrency price prediction of Ether. Using Alpaca to Trade Crypto Based on Tweet Sentiment � Download Dependencies � Import Dependencies � Define API Credentials and Variables � Create. This paper aims to prove whether Twitter data relating to cryptocurrencies can be utilized to develop advantageous crypto coin trading strategies.